Gorilla is a different kind of VC firm

Here is a article one of our portfolio founders, Jacob from Vinter.co wrote. Definitely worth to read

https://medium.com/@jacob_lindberg/gorilla-is-a-different-kind-of-vc-firm-71a8568c1143

Here is a article one of our portfolio founders, Jacob from Vinter.co wrote. Definitely worth to read

https://medium.com/@jacob_lindberg/gorilla-is-a-different-kind-of-vc-firm-71a8568c1143

In his Medium post, Matt H. Lerner, founder of Startup Core Strengths, considers the

calculations behind risk and return in venture capital. Using a Monte Carlo simulation, he

finds that ceteris paribus, a larger portfolio yields markedly better return multiples than

smaller ones.

This is chiefly due to the power law characterizing VC returns, which implies that a small

number of portfolio companies bring in a large portion of total returns. Simply put, the

more companies you have, the more likely it is that you find an outlier that ends up

becoming a unicorn and yields a gargantuan multiple.

Of course, VCs do not choose their firms randomly, and some of the top ones highly

benefit from their brand and connections which certainly boost the probability of success

for all of their respective portfolio companies. The above still holds true, and we at Gorilla

Capital have since 2012 been vocal advocates of the large portfolio approach.

The diversification benefits from having 70+ active companies in total in our Funds I & II

mean that our success is actually not even contingent on finding the occasional unicorn.

Instead, the bulk of the solid returns is generated from a large number of successful,

earlier-stage exits. However, should a portfolio company show potential to reach a billioneuro IPO, we certainly support them on their path – our approach doesn’t force any

artificial ceiling on companies.

There are some understandable reasons behind LPs preferring managers that practice

unicorn-hunting over this more sensible strategy. First, venture capital is seen as an asset

class with a high level of risk correlated with a high level of reward. LPs might feel as

though they can get solid returns with a sounder risk level from other assets. Second, the

irrational optimism characterizing the entire venture capital industry is strongly present

when funds are pitching to LPs: the dramatic, emotional and overoptimistic style often

entices more than a more cynical one.

At Gorilla, our mission is thus to show that a larger portfolio size of companies is also able

to generate sizeable returns for investors. We are essentially hedging our downside

without limiting our upside in the slightest. The success of our previous funds applying

this strategy serves as empirical proof: the general VC wisdom of unicorn-hunting can and

should be challenged.

A Tale of Two Squirrels: The Not So Simple Math on Venture Portfolio Size:

https://medium.com/@matthlerner/a-tale-of-two-squirrels-the-not-so-simple-mathon-venture-portfolio-size-b33a2de51003

Friday Mach 6, 2020

To: Gorilla Capital portfolio companies

From: Risto Rautakorpi

The Corona issue – what to think about it

Note – I focus entirely on the business implications, personal health & safety is of course #1 priority and I leave those matters for the Healthcare professionals to advise on.

I rather cry wolf than regret later, and as “only the Paranoid survives”, I’m OK to be the paranoid.

No-one knows yet what the end outcome of the Corona issue will be. But already now it has caused a visible disturbance on businesses and economies worldwide and the ripple effects are yet to be seen. Some businesses are affected more than others, but very few will be completely immune. For some (like face mask producers or remote working solutions) this can create a massive windfall.

Your business will be affected as well. In what way, when and how severely, depends. That’s what you should now form a view on, and do mitigation accordingly.

A likely scenario for anyone selling to corporations: In the 1st wave, they focus on their people risks: they cancel attending events, making business trips, they ask people to work from home etc. In the 2nd wave they do the immediate adjustments to their own business (such as airline industry), in the 3rd wave they start calculating the cost of all that, and how to balance the effect. They will try to assess what their customers do and how that will affect their own business. The 1st thing they’ll do is step on the brakes and will do only the mandatory until the dust has settled – which means anything non-mandatory will be postponed. They will try to manage costs, in anticipation of their revenues declining. This may mean layoffs, freezing any new costs (such as development projects) etc. They will have to add new issues on their agenda, changing the priorities. At this point you will start feeling the heat.

These “never seen before” crisis are part of the business cycles. I’m older than any of you so I have experienced a few (and their direct consequences) myself: oil crisis 1973, Chernobyl 1986 (this was particularly scary in Finland, due to the typical wind directions), Iraqi war and 2nd oil crisis 1990, dot com crash 2000, Financial crisis 2008. Not to mention the next tier – SARS, Thailand Tsunami etc.

It’s not a bug, it’s a feature. If you sail across the Atlantic you’re likely to get into at least one big storm. You know that from the start so you prepare accordingly. And when the weather map turns dark, you get ready: you take down sails, close all holes, tie everything down, eat and rest while you still can, make raingear readily available. When the storm hits you, you are prepared. Then you do what you must to stay afloat, and just wait. Even the worst storms end one day, the sun is shining again and smooth sailing can continue.

But while sailing after is no different from sailing before, business after a crisis is never quite the same as before. Oil crisis triggered the need to reduce dependency on oil, Financial Crisis tightened regulation of financial markets etc. The mankind is trying take measures that “this could never happen again” (rather successfully, as the next major crisis is always a “never seen before” kind). Those changes create a ton of new business opportunities.

The Corona situation – once over and back to normal - will trigger such changes as well. What exactly, we all can make educated guesses about. They too will create opportunities.

Profits are made during the high season. Strategic moves are made during the low season.

My call to action to all of you:

I sincerely hope none of this is ultimately needed and the world goes back to normal soon. But it would be irresponsible to just count on being lucky. Hope for the best, prepare for the worst!

Risto

Start with the Exit in Mind! - mini-conference was an event for startup entrepreneurs, angel investors, board members and advisors.

People presenting at the event were:

Opening and exit statistics presentation

Legal aspects of M&A presentation

Also here is link to Risto’s Linkedin post about the common “misconception” about the “exit thinking”.

A startup is like a newborn baby. The development of a baby always follows a certain sequence: learn to eat, get the digestion system going, then crawling, walking, talking, running, reading, writing etc. The first close to 20 years of a human life are spent on just learning the skills needed to be a real, adult human being. And it always happens in a certain sequence.

You don’t expect a 2 year old to be able to run a marathon, nor a 2nd grader to apply for a university.

Startups do follow a similar kind of a development. But that is poorly understood (or accepted), resulting in “2nd graders trying to get into a University, with the help of a rich dad” – in startup parlance known as “premature scaling” (usually fuelled by foie gras funding).

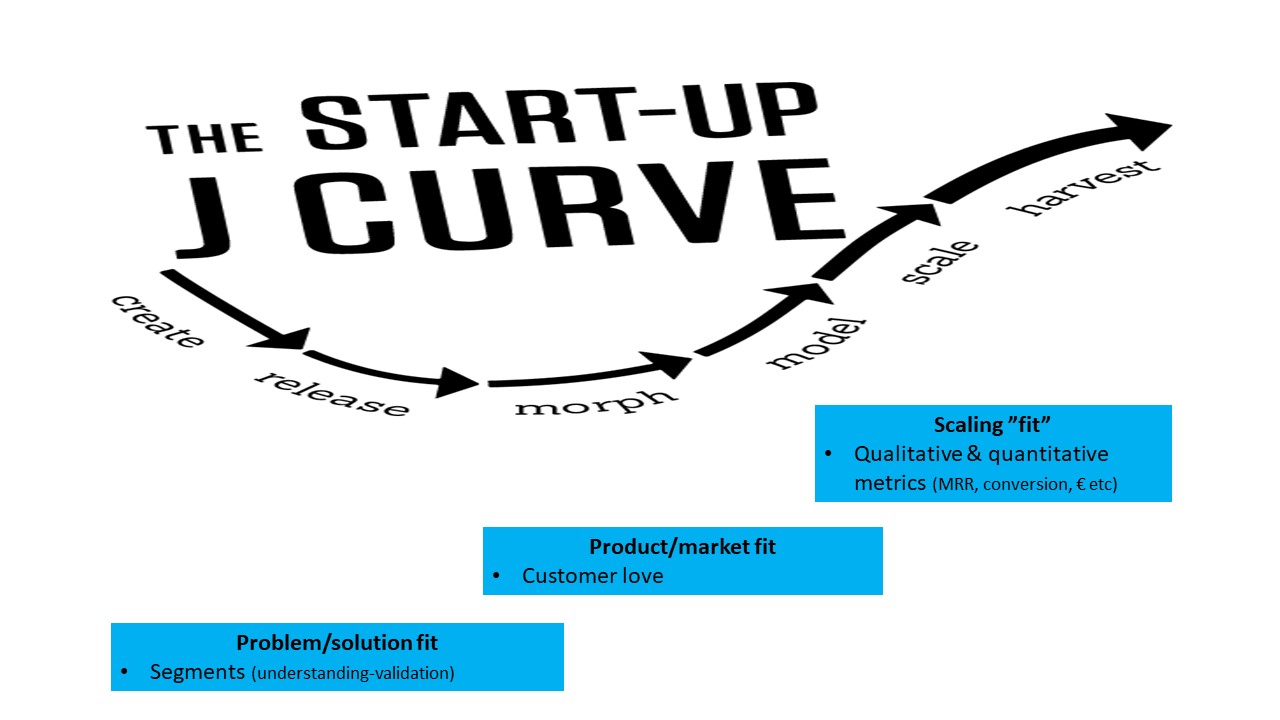

Human babies and startups alike should focus on developing skills that kids of their age are meant to. Even Wunderkinds who have special skills and are faster learners than most have to follow the same sequence, they may just advance faster. “The Startup J Curve” by Howard Love defines a 6 stage development process a startup has to go through, in sequence, to make it to the finish line. A brief summary of the stages can be found here

https://www.startupgrind.com/blog/the-startup-j-curve/

Every startup should identify their place on that curve, and understand what should and SHOULD NOT be on their priority agenda while at that stage. And when are they ready to move to the next stage.

One way to look at the stages is as a startup Founder to do list:

You should move to the next item on the list only when you have ticked the previous off. And expect to do a lot of iterations – one step forward, half a step back. Sometimes all the way back to square 1.